The S&P 500 stands as one of the most significantly identified stock marketplace indices globally, serving as a vital indicator of the health and performance of the U.S. Economy. Representing 500 of the most vital businesses at some stage in numerous industries, the S&P 500 is utilized by consumers, economists, and policymakers to gauge the marketplace and make knowledgeable choices. This article will offer a deep dive into the S&P 500, explaining its importance, how it is calculated, and how it impacts the world of investing. Solars Gadget

What is the S&P 500?

The S&P 500 (Standard & Poor’s 500) is a market-capitalization-weighted index that consists of 500 of the most important publicly traded organizations on U.S. Exchanges. It was created by using Standard & Poor’s in 1957 as a way to music the overall performance of principal U.S. Companies throughout numerous sectors, including technology, finance, healthcare, and consumer goods. The S&P 500 captures about eighty of the U.S. Inventory market’s standard price, making it a mainly representative gauge of the American monetary system.

Why the S&P 500 is Important

As a various and big-based definitely index, the S&P 500 presents insights into the regular performance of the U.S. Inventory market and, with the resource of extension, the health of the U.S. Economy. Many funding techniques are evolved across the index, and it is mostly a benchmark in competition to which character shares, mutual finances, and portfolio managers are measured. This index serves as a primary reference for every home and global customer. Solar Guides

Investor Confidence and Economic Insights

The S&P 500 is a valuable indicator of investor sentiment and financial conditions. During periods of monetary enlargement, the index has a tendency to upward thrust, reflecting accelerated consumer spending and business enterprise profitability. Conversely, in times of economic downturn, the S&P 500 frequently declines, indicating a decrease in investor confidence and organization profits. This cyclical conduct makes the S&P 500 a middle issue of market evaluation.

How the S&P 500 is Calculated

Unlike the Dow Jones Industrial Average (DJIA), which is rate-weighted, the S&P 500 uses a marketplace-cap-weighted technique, giving greater weight to businesses with better market capitalizations. This method that huge businesses like Apple, Microsoft, and Amazon have an extra effect on the index than smaller corporations inside the S&P 500. Here’s a breakdown of the calculation: Solar Gadgets Reviews

Market Capitalization Calculation: The market capitalization of every organization is decided by multiplying the stock charge by way of the type of brilliant shares.

Index Weighting: Each organization’s weight in the S&P 500 is proportional to its marketplace capitalization relative to the entire marketplace capitalization of all 500 businesses.

Index Value: The S&P 500 index fee is calculated with the resource of summing the adjusted market capitalizations and dividing through a divisor to maintain the index cost achievable and comparable over the years. This divisor is regularly adjusted for inventory splits, spinoffs, and unique agency moves.

The Companies Inside the S&P 500: A Diverse Representation

The S&P 500 incorporates 500 groups that represent a vast range of sectors, which consist of era, healthcare, financials, consumer discretionary, and industrials. This variety makes the S&P 500 a massive instance of the U.S. Economy. Some of the top businesses presently covered inside the index are: Gadgets for Travelers

Apple Inc. – Technology

Microsoft Corporation – Technology

Amazon.Com Inc. – Consumer Discretionary

Johnson & Johnson – Healthcare

Alphabet Inc. (Google) – Communication Services

Each enterprise’s performance within the index is weighted regularly with its market cap, due to this larger businesses typically tend to have a greater impact on the index’s normal motion.

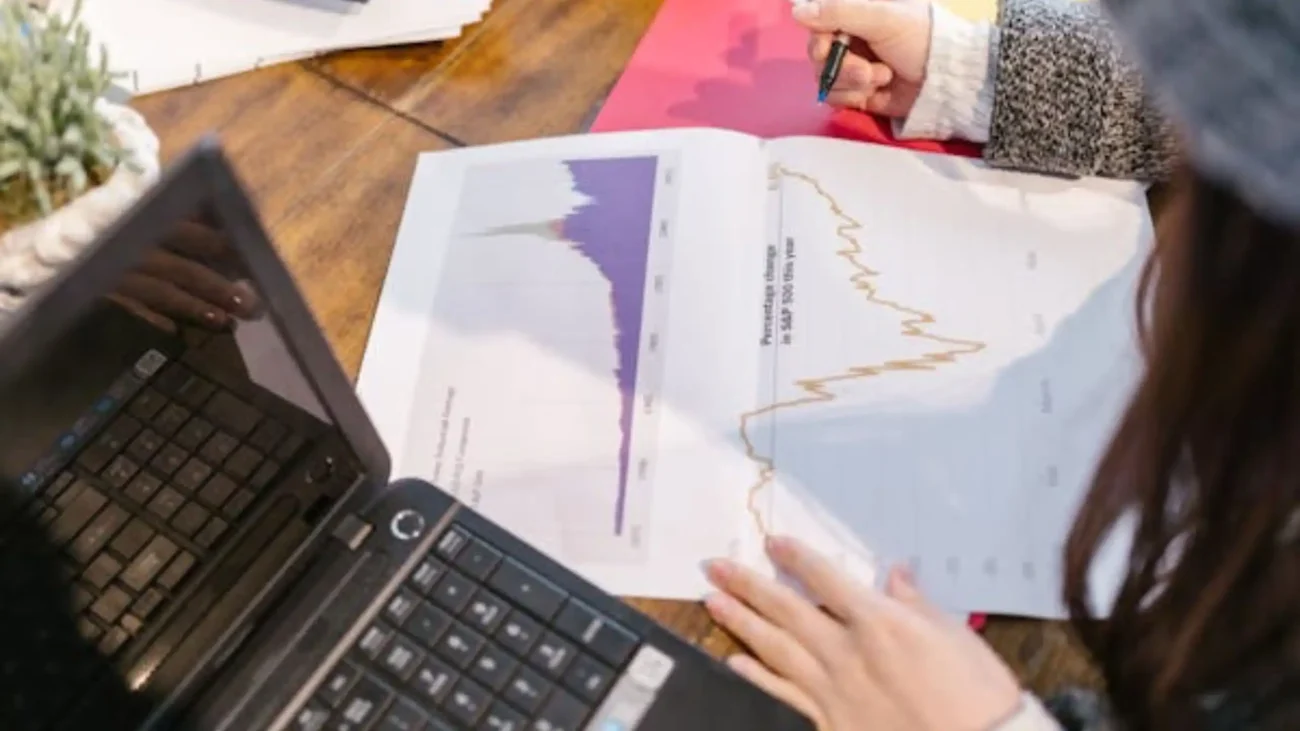

Historical Performance of the S&P 500

The S&P 500 has historically added strong returns over the long term, even though it is a scenario of quick-term volatility. Here are some key factors in its history:

The Great Depression: The index observed super losses during the Great Depression, mirroring the downturn within the financial system.

Post-War Boom: The S&P 500 experienced a robust rise at some stage in the economic increase that observed World War II. General

Dot-Com Bubble: The Nineteen Nineties tech growth pushed the index to new highs, even though it experienced a pointy decline following the dot-com crash.

2008 Financial Crisis: The index fell by way of spherical 50% from its pinnacle at some point during the global monetary crisis however rebounded in the next years.

COVID-19 Pandemic: Despite a sharp drop in early 2020, the S&P 500 rebounded suddenly as markets adjusted to pandemic situations, putting new records in the years following.

S&P 500 vs. Other Major Indices

The S&P 500 is often compared with one-of-a-kind vital indices much like the DJIA and the NASDAQ Composite. Key versions encompass:

Number of Companies: While the S&P 500 includes 500 companies, the DJIA tracks the handiest 30, and the NASDAQ Composite consists of lots however is closely weighted inside the course of tech shares.

Weighting Method: The S&P 500 is marketplace-cap-weighted, at the same time as the DJIA is price-weighted. This way large groups have more effect on the S&P 500.

Sector Representation: The S&P 500 is broader and extra varied than the DJIA, making it a greater indicator of the U.S. Economy. Blog

How to Invest in the S&P 500

Investing in the S&P 500 is a famous choice for investors looking for large publicity in the U.S. Marketplace. Here are some approaches to making investments:

Index Funds and ETFs: Many monetary establishments provide S&P 500 index finances and ETFs, inclusive of the Vanguard S&P 500 ETF (VOO) and the SPDR S&P 500 ETF (SPY), which replicate the index’s overall performance.

Mutual Funds: Some mutual budgets are designed to mirror the S&P 500, offering similar diversification and returns.

Individual Stocks: For traders trying to pick out individual stocks, purchasing shares in companies inside the S&P 500 can provide partial exposure, although it calls for an awesome degree of analysis.

Benefits of Investing in the S&P 500

Diversification

The S&P 500 includes agencies throughout many sectors, offering an immoderate degree of diversification. This reduces the risk in comparison to making an investment in a single inventory or a handful of stocks because the performance of 1 corporation or sector is much less possibly to impact the complete index drastically. Business

Historical Performance

The S&P 500 has a robust music file of increase over time. Although past overall performance does not guarantee future results, the index has normally provided solid returns over a long time, making it a desired choice for retirement debts and lengthy-time period buyers.

Liquidity and Accessibility

S&P 500 ETFs and index budgets are alternatively liquid, which means customers can without trouble purchase and sell stocks. Additionally, the large availability of those funds makes them to be had to retail buyers searching out publicity to the U.S. Market. Health

Challenges and Limitations of the S&P 500

While the S&P 500 has numerous blessings, it isn’t always without its limitations:

Market Cap Weighting: Larger businesses have a greater impact on the index, which can from time to time skew its average overall performance toward a handful of mega-cap shares.

Limited International Exposure: The S&P 500 consists of the handiest U.S.-based businesses, making it tons less ideal for traders searching out worldwide diversification.

Sector Concentration: Although the S&P 500 is various, positive sectors, particularly the era, ought to have a more awesome effect on its average overall performance inside the direction of unique intervals. Ranks Focus

The Role of the S&P 500 in Economic Analysis

The S&P 500 serves as an important tool for economists and analysts to assess financial health. Trends in the index, collectively with growing or falling charges, can provide insights into corporate profitability, client demand, and usual economic sentiment. Additionally, the S&P 500’s usual overall performance influences and is inspired by the aid of way of Federal Reserve guidelines, interest quotes, and macroeconomic situations.

Conclusion

The S&P 500 remains an essential benchmark in the global of finance, representing a massive pass-phase of the U.S. Financial gadget. Whether you’re an investor, analyst, or economist, expertise in the S&P 500 is crucial to comprehending market developments and making knowledgeable decisions. Its ancient overall performance, investment alternatives, and function as a barometer for monetary conditions underscore its importance. Blog

(FAQs) about the S&P 500

What is the S&P 500 Index?

The S&P 500, or Standard & Poor’s 500, is an inventory market index that includes 500 of the largest publicly traded groups in the United States. It is a key benchmark of the U.S. Inventory market general overall performance and is widely utilized by traders and economists to gauge the general health of the market and financial system.

How is the S&P 500 first-rate from the Dow Jones Industrial Average?

The S&P 500 is a market-capitalization-weighted index that includes 500 organizations across a couple of sectors, presenting a broader instance of the U.S. Economy. The Dow Jones Industrial Average (DJIA), however, is charge-weighted and consists of the simplest 30 companies, making it an awful lot less severe. Business Services

How is the S&P 500 calculated?

The S&P 500 is marketplace-capitalization-weighted, because of this groups with large market caps have an extra effect on the index’s value. The index price is derived by dividing the entire market cap of its 500 corporations through a general divisor that keeps consistency irrespective of company movements like stock splits.

Why is the S&P 500 important for investors?

The S&P 500 is taken into consideration as a main indicator of U.S. Financial overall performance. It displays developments in a massive array of industries, permitting investors to gauge the overall marketplace fitness. Many mutual finances and ETFs are based mostly on the S&P 500, making it a critical device for numerous funding. Fashion

How can I invest within the S&P 500?

You can’t invest straight away within the S&P 500, however, you could invest in index finances and ETFs that replicate the index’s performance, including the SPDR S&P 500 ETF (SPY) and the Vanguard S&P 500 ETF (VOO). These rate varieties offer you publicity for all the companies inside the index.

What sectors are represented within the S&P 500?

The S&P 500 consists of companies from diverse sectors, together with era, healthcare, finance, consumer discretionary, industrials, and electricity. This diversification enables us to represent the general overall performance of the U.S. Economy more notably. General

How regularly is the S&P 500 up to date?

The S&P 500 is periodically reviewed and up to date via a committee. Companies can be delivered or eliminated based on factors that incorporate market cap, economic health, and representation of industries to ensure the index accurately presents the contemporary economic device.

What elements affect the S&P 500’s performance?

The S&P 500’s performance is affected by a selection of things, which include financial signs and symptoms (like GDP growth, inflation, and unemployment), Federal Reserve interest price guidelines, company profits, and worldwide activities. Health & Fitness

How has the S&P 500 finished traditionally?

The S&P 500 has usually furnished sturdy lengthy-term returns, even though it can be volatile in the short term. Significant declines befell for the duration of activities just like the 2008 monetary crisis and the COVID-19 pandemic, however, the index has proven resilience and growth over time.

Is the S&P 500 a high-quality indicator of the U.S. Economy?

While the S&P 500 is one of the superb indicators of the U.S. Inventory market and shows a massive part of the economic system, it doesn’t represent all sectors similarly and consists of fine massive-cap businesses. For a broader view, it is able to be complemented with the aid of an approach of different indices similar to the Russell 2000 for smaller-cap shares. News